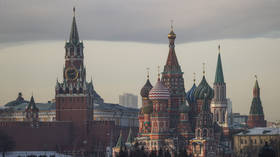

Sinking global economy & cheap crude take big bite out of Russia’s forex reserves

Russian gold and foreign currency holdings have shed almost $30 billion or more than five percent in one week in the biggest drop since the global financial crisis amid the coronavirus pandemic and crashing oil prices.

According to the latest data released by the country’s central bank, the reserves stood at $551.2 billion as of March 20, down from $581 billion a week earlier. The regulator explained the decline with negative revaluation.

The nation’s forex holdings faced almost a similar drop in October 2008, when the reserves shrank by $30.6 billion to $487 billion. Another steep decline occurred in the beginning of 2009, as $30.3 billion vanished from Russia’s coffers as the consequences of the financial crisis were still wreaking havoc around the globe.

Also on rt.com Russian economy can survive for a long time with oil at $20 per barrelDespite the steep fall, the international reserves that are comprised of stocks of monetary gold, foreign currencies and Special Drawing Right (SDR) assets, are still above the target of half a trillion dollars set by the central bank several years ago.

Analysts earlier stressed the accumulated funds can shield the Russian economy from any turbulence in the global energy and stock markets. Some predicted that Moscow can survive up to two years with extremely low oil prices, while they still expect that the market is set to stabilize in the next few months.

For more stories on economy & finance visit RT's business section