World’s super-rich are hoarding physical gold in secret bunkers

The strategic case for owning gold remains strong, according to analysts at Goldman Sachs. They point to such factors as political uncertainty, recession fears and other worries among the global elite.

Data from Goldman research showed that owning the physical metal seems to be the global elite’s preferred way to hedge against tail events. Physical buying of gold has increased at a rapid pace in the past three years, statistics showed.

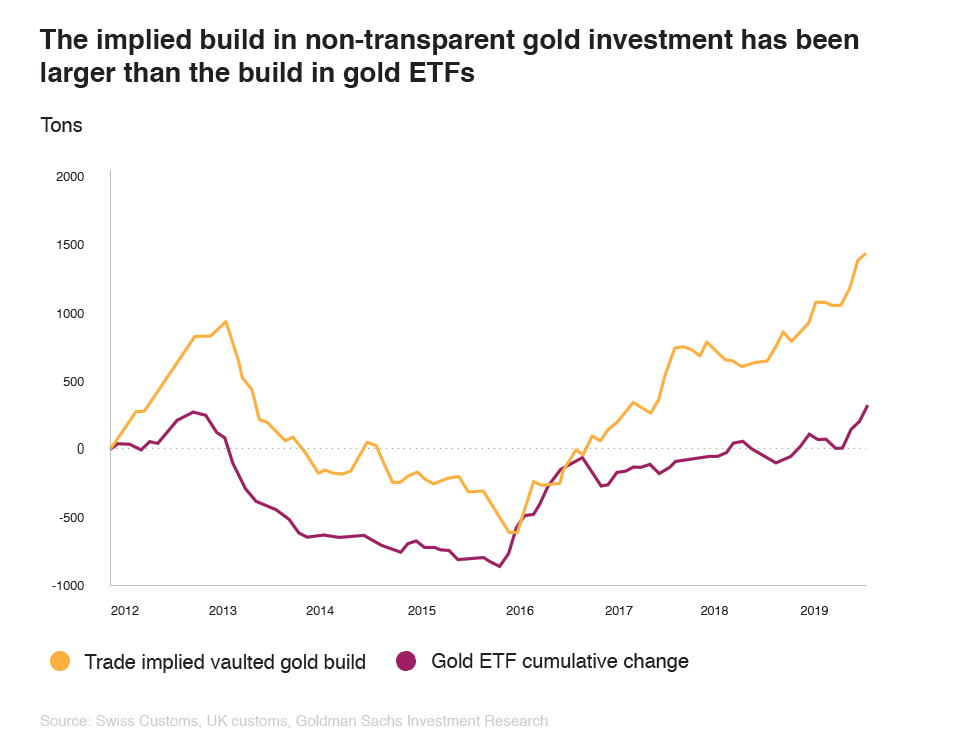

"Since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build in visible gold ETFs (Exchange-traded funds)," Goldman said in a note sent to clients and seen by Yahoo Finance.

Also on rt.com Hamptons’ ‘paranoid’ super rich installing luxury panic rooms to hide from MS-13 gangThat simply means that for those including gold in their luxurious bunkers, demand for which has been growing at a fast pace, owning bullion is a must.

"This [data] is consistent with reports that vault demand globally is surging," Goldman said.

Gary Lynch, general manager of Texas-based Rising S Company, told CNN that 2016 sales for their custom high-end underground bunkers grew 700 percent compared to 2015, while overall sales have grown 300 percent since the November US presidential election alone.

"Political risks, in our view, help explain this, because if an individual is trying to minimize the risks of sanctions or wealth taxes, then buying physical gold bars and storing them in a vault - where it is more difficult for governments to reach them - makes sense.”

The investment bank added: "Finally, this build can also reflect hedges by global high net worth individuals against tail economic and political risk scenarios in which they do not want to have any financial entity intermediating their gold positions due to the counter-party credit risk involved."

For more stories on economy & finance visit RT's business section