Shale’s debt-fueled drilling boom is coming to an end

The financial struggles of the US shale industry are becoming increasingly hard to ignore, but drillers in Appalachia are in particularly bad shape.

The Permian has recently seen job losses, and for the first time since 2016, the hottest shale basin in the world has seen job growth lag the broader Texas economy. The industry is cutting back amid heightened financial scrutiny from investors, as debt-fueled drilling has become increasingly hard to justify.

But E&P companies focused almost exclusively on gas, such as those in the Marcellus and Utica shales, are in even worse shape. An IEEFA analysis found that seven of the largest producers in Appalachia burned through about a half billion dollars in the third quarter.

Gas production continues to rise, but profits remain elusive. “Despite booming gas output, Appalachian oil and gas companies consistently failed to produce positive cash flow over the past five quarters,” the authors of the IEEFA report said.

Of the seven companies analyzed, five had negative cash flow, including Antero Resources, Chesapeake Energy, EQT, Range Resources, and Southwestern Energy. Only Cabot Oil & Gas and Gulfport Energy had positive cash flow in the third quarter.

The sector was weighed down but a sharp drop in natural gas prices, with Henry Hub off by 18 percent compared to a year earlier. But the losses are highly problematic. After all, we are more than a decade into the shale revolution and the industry is still not really able to post positive cash flow. Worse, these are not the laggards; these are the largest producers in the region.

The outlook is not encouraging. The gas glut is expected to stick around for a few years. Bank of America Merrill Lynch has repeatedly warned that unless there is an unusually frigid winter, which could lead to higher-than-expected demand, the gas market is headed for trouble. “A mild winter across the northern hemisphere or a worsening macro backdrop could be catastrophic for gas prices in all regions,” Bank of America said in a note in October.

The problem for Appalachian drillers is that Permian producers are not really interested in all of the gas they are producing. That makes them unresponsive to price signals. Gas prices in the Permian have plunged close to zero, and have at times turned negative, but gas production in Texas really hinges on the industry’s interest in oil. This dynamic means that the gas glut becomes entrenched longer than it otherwise might. It’s a grim reality plaguing the gas-focused producers in Appalachia.

Also on rt.com The real history of fracking: Oil, bombs and civil warWith capital markets growing less friendly, the only response for drillers is to cut back. IEEFA notes that drilling permits in Pennsylvania in October fell by half from the same month a year earlier. The number of rigs sidelined and the number of workers cut from payrolls also continues to pile up.

The negative cash flow in the third quarter was led by Chesapeake Energy (-$264 million) and EQT (-$173 million), but the red ink is only the latest in a string of losses for the sector over the last few years. As a result, the sector has completely fallen out of favor with investors.

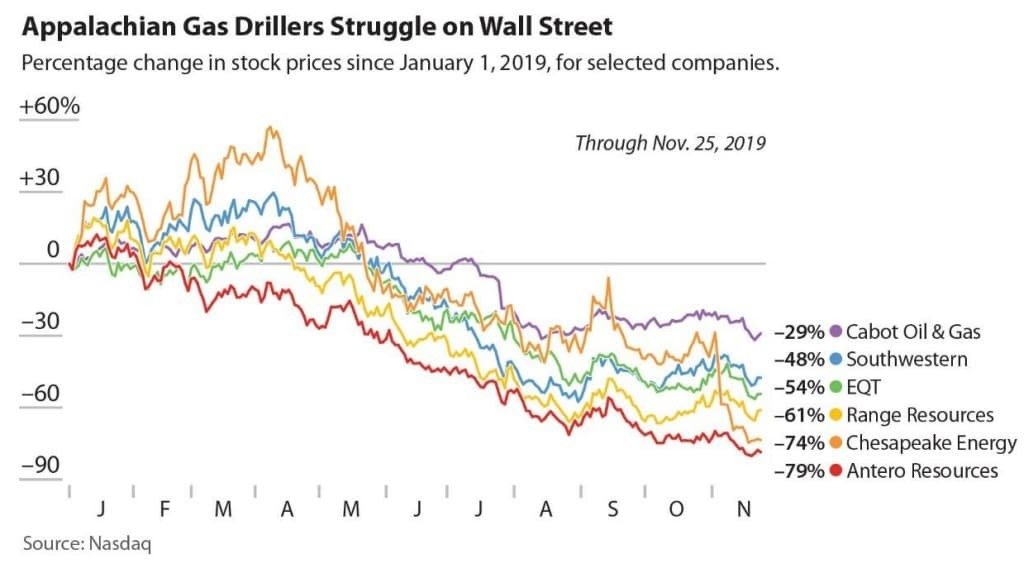

But gas drillers have fared worse, with share prices lagging not just the broader S&P 500, but also the fracking-focused XOP ETF, which has fallen sharply this year. In other words, oil companies have seen their share prices hit hard, but gas drillers have completely fallen off of a cliff. Chesapeake Energy even warned last month that it there was “substantial doubt about our ability to continue as a going concern.” Its stock is trading below $1 per share.

Even Cabot Oil & Gas, which posted positive cash flow in the third quarter, has seen its share price fall by roughly 30 percent year-to-date. “Even though Appalachian gas companies have proven that they can produce abundant supplies of gas, their financial struggles show that the business case for fracking remains unproven,” IEEFA concluded.

This article was originally published on Oilprice.com